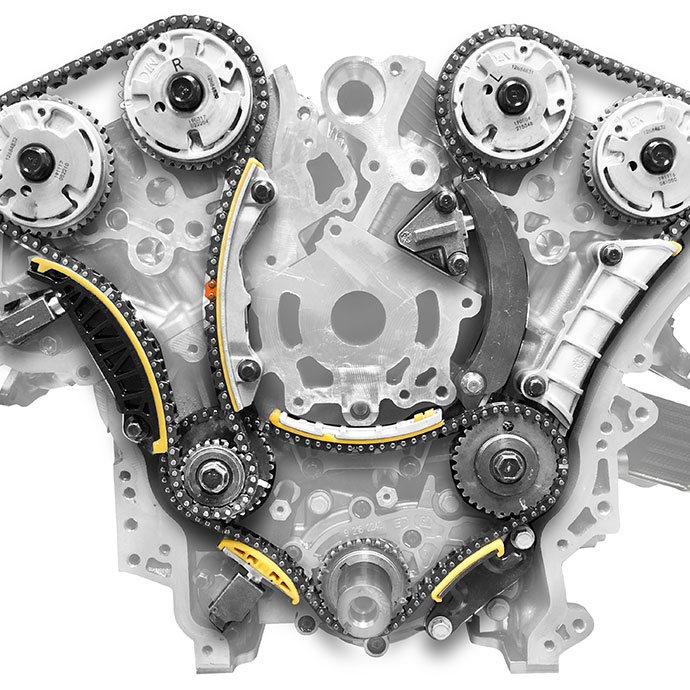

Cloyes is the North American leader and global designer, developer, manufacturer and distributor of mission-critical timing drive systems and components for the automotive aftermarket. Founded in 1921, the Company leverages their superior quality and best-in-class VIO (“vehicles in operation”) coverage to produce mission critical components used in high-performance and replacement applications. Cloyes serves a broad customer base, including wholesale distributors, national and local retailers, re-packagers, and production engine builders, and sells its products under the Cloyes® brand throughout North America and Dynagear® in Mexico.